|

Getting your Trinity Audio player ready...

|

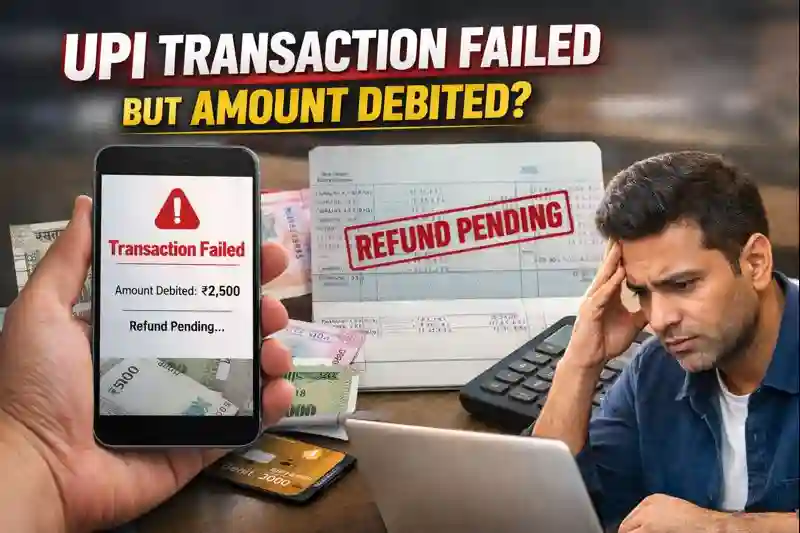

UPI Transaction Failed but Amount Debited – How to Get Money Back (2026 Complete Guide)

In my experience as an IT professional, “UPI transaction failed but amount debited” is one of the most searched problems in India right now.

Many Nexdigit readers tell us the same story: payment failed on screen, but money still went from the bank account.

This situation is stressful—especially for beginners and non-technical users. The good news is your money is usually safe. In most cases, the amount is automatically refunded within a few days.

Table of Contents

ToggleIn this 2026-updated guide, I’ll explain why this happens, how to check your refund status, and exact steps to get your money back—based on real user cases, official rules, and safe practices.

What Does “UPI Transaction Failed but Amount Debited” Mean?

Simply put:

- You tried to pay using UPI

- The app showed “Failed” or “Pending”

- But the bank account was debited

This happens when communication between the bank and the UPI system breaks.

UPI works through National Payments Corporation of India (NPCI), which connects:

- Your bank

- The merchant’s bank

- Your UPI app

If even one step fails, money may be debited temporarily.

Top 10 Cybersecurity Threats: How to Protect Yourself Online

Common Reasons for UPI Failed but Amount Debited

1. Server or Network Issues

Heavy traffic on UPI servers, especially during peak hours.

2. Bank Server Down

Your bank’s system may not respond on time.

3. Internet Fluctuation

Weak or unstable mobile data/Wi-Fi.

4. Merchant Bank Delay

Merchant’s bank did not confirm payment.

5. App Crash or Timeout

The UPI app closed before confirmation.

⚠️ Important: This is not fraud in most cases. It’s a technical delay.

How Long Does UPI Refund Take? (Updated 2026 Rules)

According to NPCI guidelines:

| Situation | Refund Time |

|---|---|

| Auto-refund (most cases) | T+1 to T+3 working days |

| Bank-level delay | Up to 5 working days |

| After complaint | 7–10 working days |

If refund doesn’t arrive after this, manual complaint is required.

Step-by-Step: What to Do Immediately (Very Important)

Step 1: Do NOT Panic

In 90% of cases, refund happens automatically.

Step 2: Check Transaction Status

Open your UPI app and check:

- Status: Failed / Pending

- UTR / Transaction ID

Save a screenshot.

Step 3: Check Bank Account Statement

Sometimes the amount comes back but you miss it.

Check:

- Mini statement

- Bank SMS

- Mobile banking app

How to Stop Spam Calls in India Without Using Truecaller

How to Get Money Back from Popular UPI Apps

🔵 Google Pay (GPay)

- Open Google Pay

- Tap the failed transaction

- Select “Get Help”

- Submit complaint with details

🟣 PhonePe

- Open PhonePe

- Go to History

- Select transaction → Contact Support

- Choose “Money Debited but Failed”

🔷 Paytm

- Open Paytm

- Tap transaction

- Click Report a Problem

- Upload screenshot if asked

If App Support Doesn’t Help: Contact Your Bank

This is the most effective step.

How to Contact Bank Support

- Customer care number

- Bank email

- Branch visit (with UTR)

Provide:

- Transaction ID (UTR)

- Date & time

- Amount

- UPI app used

Banks are legally required to resolve this.

How to Remove Your Personal Data from Data Broker Sites in 2025 [Complete Guide]

File Official UPI Complaint Online (NPCI Method)

If bank/app delays response:

- Visit NPCI grievance portal

- Choose UPI Related Issue

- Fill transaction details

- Submit complaint

NPCI usually responds within 3–5 working days.

RBI Rule You Should Know (Very Important)

As per Reserve Bank of India (RBI) rules:

- Banks must resolve UPI failed transactions

- Delays can lead to penalties on banks

- Customers have the right to escalation

This is why refunds usually come.

Common Mistakes That Delay Refunds

❌ Filing multiple complaints

❌ Entering wrong UTR

❌ Raising dispute too early (before 24 hours)

❌ Not checking bank statement properly

✔️ Always wait 24–48 hours before escalating.

Is It Cyber Crime or Technical Issue?

| Situation | Type |

|---|---|

| Failed + auto refund | Technical |

| Failed + no refund after 10 days | Complaint case |

| Unknown merchant | Possible fraud |

| OTP sharing | Cyber crime |

For fraud cases, report at:

cybercrime.gov.in

11 Ways to Make Your Online Shopping Safer & More Secure

Safety Tips to Avoid This Issue Again

- Avoid peak hours (8–10 PM)

- Keep only 1 active UPI app

- Use stable internet

- Don’t retry payment immediately

- Update UPI app regularly

Pros & Cons of UPI System (Honest View)

✅ Pros

- Instant payments

- Free transactions

- Works 24/7

❌ Cons

- Server dependency

- Occasional delays

- Refund time confusion

Despite issues, UPI is still India’s safest digital payment system.

Key Takeaways (Must Read)

- Most UPI failed transactions are auto-refunded

- Always save UTR number

- Bank support > App support

- NPCI & RBI protect users

- Panic never helps—process does

Conclusion: Don’t Panic—Follow the Process

UPI transaction failed but amount debited is frustrating, but not dangerous if handled correctly.

From my real-world experience, users who follow steps calmly get their money back without issues.

Always remember:

- Save proof

- Wait reasonable time

- Escalate properly

UPI is built with strong consumer protection, and your money is not lost.

FAQs: UPI Transaction Failed but Amount Debited

1. Will I definitely get my money back?

No, getting your money back is not guaranteed—it depends on the company’s refund policy, the payment method used, and how quickly you report the issue.

2. How many days should I wait?

Up to 3 working days before complaint.

3. Is UPI failure a scam?

No, usually technical.

4. What if merchant says payment not received?

Ask them to check with UTR.

5. Can bank refuse refund?

No, if transaction truly failed.

6. Should I file cyber crime complaint?

Only if fraud is suspected.

7. Is visiting bank branch helpful?

Yes, for faster resolution.

8. Does NPCI really help?

Yes, especially when banks delay.

9. Can UPI money get stuck forever?

Practically no, if followed correctly.